per capita tax reading pa

10 Fairlane Road PO Box 4216 Reading PA 19606 Ph. And if its impossible what happens if I dont pay it.

Medicare Beneficiaries Out Of Pocket Health Care Spending As A Share Of Income Now And Projections For The Future Via Health Care Medicare Medical Billing

What is the Per Capita Tax.

. With an estimated population of 95112 as of the 2020 census it is the fourth most populated city in. Governor Mifflin School District - 1000. The municipal tax is 500 and the school tax is 1000 These taxes are due on an annual basis.

Per Capita Tax. When is it levied. Infrastructure Tax - 100 mills.

Does he even owe occupational taxes. Is this tax withheld by my employer. Current Governor Mifflin School Real Estate Tax - The current Governor Mifflin School District Real Estate Tax rate is 245 Mills.

Elco School District Real Estate Tax 2020-2021. Mail Completed Form To. Keystone is New Per Capita Tax Collector in Reading.

The commonwealth ranking has remained unchanged at 21st rising to 15th in 2011. They are going back prior to 1994 asking for per capita and occupation taxes. In computing per capita personal income BEA uses the Census Bureaus annual midyear population estimates.

5 per person over 18 years old. Normally the Per Capita tax is NOT. Wyomissing Area School District Tax - The Wyomissing Area School District real estate and per capita taxes are established by the school board.

Wilson school district 2601. The City of Corry Per Capita tax is 1500. Payments may be mailed to.

Beginning in 2020 these two taxes will be included on one bill which. The City of Reading and the Reading School District have asked Keystone Collections Group to collect their combined 30 annual per capita tax looking to increase revenues through greater tax compliance. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction.

School District or Municipality. For most areas adult is defined as 18 years of age and older. Graph and download economic data for Per Capita Personal Income in Reading PA MSA READ742PCPI from 1969 to 2020 about Reading PA personal income per capita personal income and USA.

Tax Collector Kristi Piersol is the Townships elected Tax Collector and is responsible for collecting Real Estate Taxes and Per Capita Taxes. The local political subdivisions for whom the tax is collected compensate the Treasurer and hisher staff equally to reimburse for the cost of collections. Per Capita means by head so this tax is commonly called a head tax.

I had never received it it before. Berks County Municipalities Borough of Kenhorst. Discount Amount Taxes must be paid by September30 for 2 discount.

The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions. Is it legal for them to garnish MY pay for this. My pay is being garnished for per capita taxes and occupation assessments for my husband disabled in 2000.

Elco School District Per Capita Tax. However from 2012 through 2014 Other State Funds more than doubled resulting in much higher per capita expenditures for the next three years. Real Estate Taxes are collected by the Lebanon County Treasurers Office.

Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Diamond is the Townships elected Tax Collector and is responsible for collecting Real Estate Taxes and Per Capita Taxes. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district.

The City Treasurer is authorized by law and local political subdivision to be the collection agent for City School and County Per Capita Taxes. PO BOx519 IrwInPA 15642. Real Estate Tax - 725 mills.

Monday through Friday -. There is a 2 discount available for payments made in March andor April of the current tax year. Reminder to pay your Per Capita tax bill before December 31st.

Kenhorst Borough - 500. How can I get out of paying a per capita tax in PennsylvaniaAfter filing federal and state tax returns I got a per capita bill in the mail. Measures the size and activity-level of state government as well as the potential tax burden on business.

All july per capita and real estate tax bills are due by december 31 2021. This universal application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions. West Reading Borough Tax Rates.

My husband has been on disability since 2000. Access Keystones e-Pay to get started. This measure of income is calculated as the personal income of the residents of a given area divided by the resident population of the area.

How do I get out of paying it. Current Per Capita Taxes. 10 Fairlane Road PO Box 4216 Reading PA 19606 610 779-8055.

Exoneration from tax is applicable to the current tax year only. Fire Protection Tax - 285 mills. The wilson school district tax office normal business hours of monday friday 730 am 400 pm.

ACT 679 Tax is a 500 Per Capita Tax authorized under the PA School Code and is addition to the 1000 Per Capita that can be levied and shared by your school district with your municipality. Exemption from tax is applicable to the current tax year only. Do I pay this tax if I rent.

Office hours vary and can be found on the tax bills. Per capita exemption requests can be submitted online. The school district as well as the township or borough in which you reside may levy a per capita tax.

Mifflin School District Per Capita Tax - 1470 for every person over 18 years of age who resides within the school district. PER CAPITA TAX INFORMATION. It is not dependent upon employment.

If I pay this late is there a penalty applied. Per Capita Tax Exemption Form. 1000 annually per individual.

City of Reading. Office hours vary and can be found on the tax bills. Residents can expect to receive their per capita tax bill in the mail as soon as July 1.

He has not worked since 2000. Residents of Lower Alsace Township or Mount Penn Borough 18 years of age and older regardless of work status. Payments are not accepted at Borough Hall.

Fiscal year starts March 1. Per Capita taxes are assessed by the Municipality and the Franklin Regional School District on all residents who have attained the age of twenty-one 21. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

The City of Reading located in southeastern Pennsylvania is the principal city of the Greater Reading Area and the county seat for Berks County. Berks County Real Estate Tax - 76570 mills.

Fillable Online Helpmegrowutah 14 Month Asq 3 Information Summary Help Me Grow Utah Fax Email Print Pdffiller

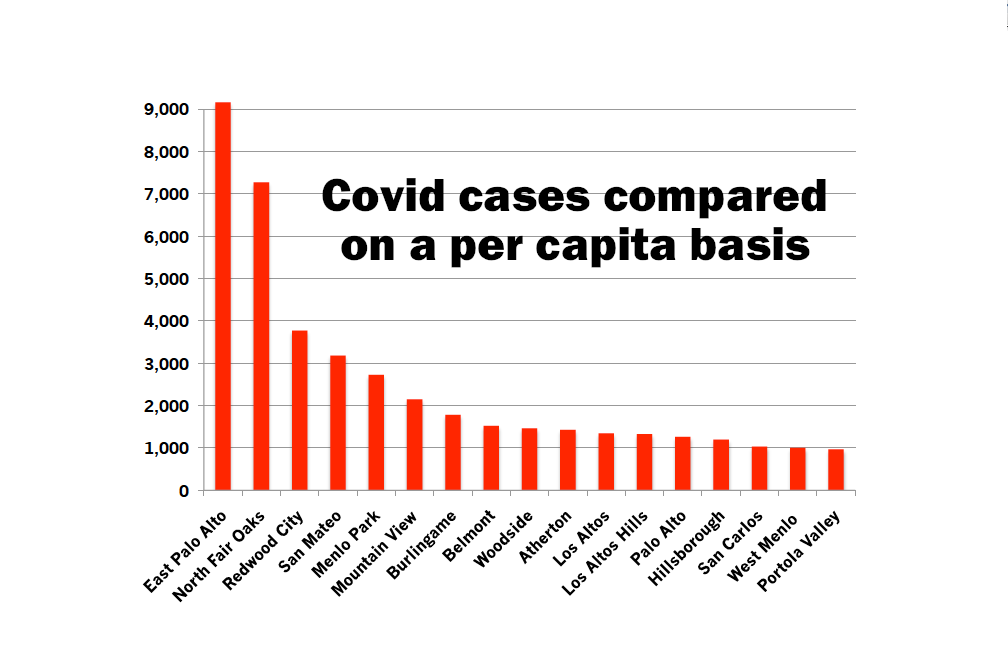

Covid Rates Much Higher Per Capita In East Palo Alto And North Palo Alto Daily Post

Per Capita Tax Exemption Form Keystone Collections Group

State Local Property Tax Collections Per Capita Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Explore Per Capita Income In The United States 2021 Annual Report Ahr

Ymca Step Test Chart Fill Online Printable Fillable Blank Pdffiller

Per Capita Tax Exemption Form Keystone Collections Group

Real Estate And Per Capita Tax Wilson School District Berks County Pa